地政士及不動產經紀業防制洗錢及打擊資恐辦法修正條文 事項總說明(AML / CFT

內政部每年應查核地政士及不動產經紀業辦理防制洗錢及打擊資恐內部控制措施及稽核制度之執行情形,並得委任所屬機關或委託、委辦其他機關(構)、法人或團體辦理。

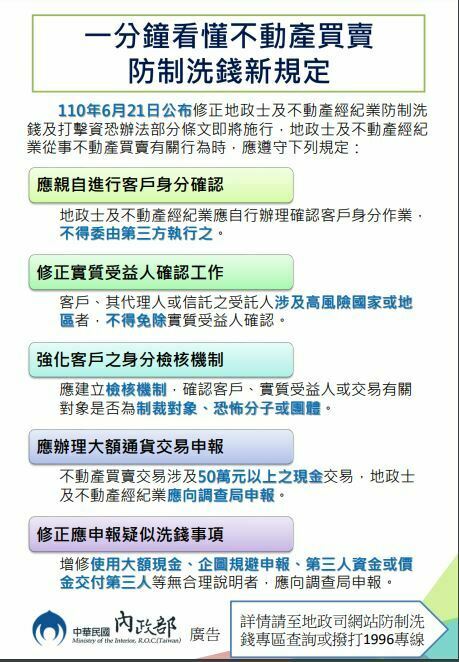

地政士及不動產經紀業是資金流通的重要環節,也是洗錢和資恐活動的高風險行業之一。因此,政府針對這些行業實行了一系列的防制洗錢及打擊資恐辦法,以下是其中的一些:

- 監管規範:政府通過立法、制定相關法規和政策,對地政士及不動產經紀業的營業範圍、開展業務的方式、客戶身份驗證等方面進行監管規範。

- 客戶身份驗證:地政士及不動產經紀業在開展業務時,需要對客戶的身份進行驗證,核實客戶的身份證明、聯繫方式、財務狀況等信息,以確保客戶真實可靠。

- 洗錢風險評估:地政士及不動產經紀業需要對客戶的交易行為進行洗錢風險評估,例如是否涉及高風險國家或地區的資金來源等,以便及早發現、防範洗錢行為。

- 資料記錄與報告:地政士及不動產經紀業需要對客戶的交易活動進行詳細的資料記錄,包括交易對象、交易金額、交易方式等信息,并向相關機構報告可疑交易或交易疑點。

- 員工培訓:地政士及不動產經紀業需要對員工進行相關的培訓,使其了解防制洗錢和打擊資恐的重要性,掌握相應的風險評估和交易記錄報告技能。

- 合作交流:地政士及不動產經紀業需要加強與金融機構、執法部門等相關機構的合作交流,建立信息共享機制,及時發現和打擊洗錢和資恐活動。

總之,地政士及不動產經紀業需要加強自身的風險防範能力,透過合規經營、員工。

地政士及不動產經紀業防制洗錢及

打擊資恐辦法 – 全國法規資料庫

第 1 條:

規定訂定

本辦法依洗錢防制法第六條第三項、第七條第四項、第八條第三項、第九條第三項、第十條第三項及資恐防制法第七條第五項規定訂定之。

第 2 條:

本辦法用詞定義如下:

一、地政士:指依地政士法規定領有地政士證書或土地登記專業代理人證書,並領得地政士開業執照,執行地政士業務者。

二、不動產經紀業:指依不動產經紀業管理條例規定,經營不動產仲介或代銷業務之公司或商號。

三、客戶:指不動產買賣交易之雙方當事人。

四、實質受益人:指對客戶具最終所有權或控制權之自然人,或由他人代理交易之自然人本人,包括對法人或法律協議具最終有效控制權之自然人。

五、高風險國家或地區:指洗錢防制法第十一條第二項所列之國家或地區。

六、業務關係:指五年內累計為同一客戶辦理三次以上不動產買賣交易。

七、一定金額:指新臺幣五十萬元或等值外幣。

八、通貨交易:指單筆現金收受或支付。

第 3 條:

不動產買賣交易有關行為

地政士及不動產經紀業從事不動產買賣交易有關行為時,應依本辦法辦理防制洗錢及打擊資恐工作。

第 4 條:

控制措施及稽核制度:

地政士及不動產經紀業應按洗錢與資恐風險及業務規模,依下列規定建立內部控制措施及稽核制度:

一、由高階主管或其授權人員核定防制洗錢作業及控制程序,並定期更新之。

二、指派專責人員負責協調及監督前款措施之執行。

三、定期舉辦或參加防制洗錢及打擊資恐在職訓練。

四、製作並定期更新防制洗錢及打擊資恐風險評估報告。

五、注意員工有無地政士法第六條第一項或不動產經紀業管理條例第十四條第三項規定不得充任情形。

六、建立稽核程序。

前項第四款風險評估報告,應考量客戶、產品及服務之性質,是否涉及高風險國家或地區,及價金支付管道等風險因素製作。

第 5 條:

不得規避、拒絕或妨礙查核

內政部每年應查核地政士及不動產經紀業辦理防制洗錢及打擊資恐內部控制措施及稽核制度之執行情形,並得委任所屬機關或委託、委辦其他機關(構)、法人或團體辦理。

前項查核得採現地或非現地查核方式辦理,地政士及不動產經紀業不得規避、拒絕或妨礙查核。

第 6 條:

建立降低風險之管理措施

地政士及不動產經紀業於推出新產品或服務前,應進行洗錢及資恐風險評估,並建立降低風險之管理措施。

前項新產品或服務,包括運用新支付機制或新科技於相關產品或服務之情形。

第 7 條:

應確認客戶身分

地政士及不動產經紀業於下列情形時,應確認客戶身分:

一、進行不動產買賣交易。

二、建立業務關係。

三、發現疑似洗錢或資恐交易。

四、對於過去取得客戶身分資料之真實性有所懷疑。

地政士及不動產經紀業,不得接受客戶以匿名或使用假名進行交易。

地政士及不動產經紀業與客戶建立業務關係時,應瞭解該業務關係之目的及性質。

第 7-1 條:

確認客戶身分作業,不得委由第三方執行

地政士及不動產經紀業應自行辦理確認客戶身分作業,不得委由第三方執行之。

第 8 條:

確認客戶身分,及留存或記錄其身分資料

地政士及不動產經紀業確認客戶身分,及留存或記錄其身分資料,應依下列規定辦理:

一、客戶為自然人者,應檢視其國民身分證、健保卡、護照、居留證或其他可資證明身分之證明文件,留存或記錄其姓名、出生年月日、地址及統一編號等身分資料,並徵詢其職業及聯絡電話號碼記錄之。

二、客戶為法人或團體者,應留存或記錄下列資料,以瞭解客戶主要業務性質:

(一)名稱、統一編號、聯絡電話及負責人姓名。

(二)設立或登記證明文件。

(三)章程。但依規定無須訂定章程或屬第五項所列對象者,不在此限。

(四)董事、監察人或理事、監事名冊。但依規定無須設置者,不在此限。

(五)註冊登記地址及主要之營業處所地址。

不動產買賣交易有關之行為由客戶代理人為之者,準用前項規定,確認代理人身分及留存或記錄身分資料,並應確認其代理權之真實性。

客戶為法人或團體者,地政士及不動產經紀業,應瞭解其所有權及控制權結構,依下列規定確認實質受益人身分資料,並留存或記錄之:

一、請客戶提供具最終控制權之自然人身分資料,即直接或間接持有該法人股份或資本超過百分之二十五之股東名冊或相關文件。

二、未能依前款發現具控制權之自然人或有所懷疑者,應辨識有無透過其他方式對客戶行使控制權之自然人;仍未發現者,應確認其董事、監察人或相當職位之自然人身分。

不動產買賣交易有關之行為由信託之受託人為之或將不動產權利指定登記予第三人者,準用第一項及前項所定身分資料,確認客戶及其信託之受託人、監察人、受益人或第三人身分,並留存或記錄之。

客戶、其代理人或信託之受託人具有下列身分,且未涉及高風險國家或地區者,不適用前二項確認實質受益人之規定:

一、我國政府機關、公營事業機構或公私立學校。

二、外國政府機關。

三、我國上市、上櫃公司或其子公司。

四、於國外掛牌並依掛牌所在地規定,應揭露其主要股東之股票上市、上櫃公司或其子公司。

五、我國金融機構或於我國設立分公司之外國金融機構。

六、設立於我國境外,且所受監理規範與防制洗錢金融行動工作組織(FATF)所定防制洗錢及打擊資恐標準一致之金融機構。

第一項至第四項身分資料,地政士及不動產經紀業應自交易終止或完成時起,至少保存五年。但其他法律有規定較長保存期間者,從其規定。

第 8-1 條:

確認客戶身分外,應依下列規定辦理檢核

地政士及不動產經紀業除依前條規定確認客戶身分外,應依下列規定辦理檢核:

一、依據風險基礎方法,建立客戶及交易有關對象之姓名及名稱檢核方法或作業程序,以辨識客戶、客戶之實質受益人或交易有關對象是否為資恐防制法指定制裁之個人、法人或團體,以及外國政府或國際組織認定或追查之恐怖分子或團體。

二、前款辦理情形應予留存或記錄,保存期間同前條第六項規定。

第 9 條:

確認身分時,有下列情形者,應即婉拒進行交易

地政士及不動產經紀業於確認客戶身分時,有下列情形之一者,應即婉拒進行交易:

一、疑似使用匿名、假名、人頭、虛設行號或虛設法人團體名義進行交易。

二、拒絕提供確認身分所需相關文件。

三、持用偽、變造身分證明文件。

四、客戶為資恐防制法指定制裁之個人、法人或團體,及外國政府或國際組織認定或追查之恐怖分子或團體。

五、有下列情形之一,合理懷疑客戶可能涉及洗錢或資恐行為:

(一)出示之身分證明文件均為影本。

(二)提供文件資料可疑、模糊不清,無法進行查證,或不願提供其他佐證資料。

(三)無故拖延應提供或補充之身分證明文件。

(四)其他異常情形,無法提出合理說明。

第 10 條:

建立業務關係之客戶,應持續實施審查

地政士及不動產經紀業對建立業務關係之客戶,應依下列原則持續實施審查:

一、對客戶之交易進行詳細審視,確保該交易與客戶之業務特性與洗錢及資恐風險相符,必要時並應瞭解其資金來源。

二、定期檢視客戶及實質受益人身分資料是否足夠。

三、依客戶之重要性、風險程度及前次審查情形,重新對既存客戶進行身分審查;得知客戶身分與背景資訊有重大變動時,亦同。

四、對客戶資訊之真實性有所懷疑、發現客戶涉及疑似洗錢或資恐交易或客戶之交易方式出現異常重大變動時,應依第八條規定再次確認客戶身分。

第 11 條:

屬高洗錢或資恐風險者,應強化確認客戶身分

地政士及不動產經紀業對於客戶或其交易涉及國家或地區,屬高洗錢或資恐風險者,應採取下列強化確認客戶身分措施:

一、在進行交易前,應取得高階管理人員同意。

二、採取合理措施以瞭解客戶資金來源。

三、持續監督進行中之交易。

第 12 條:

受益人與其家庭成員及有密切關係之人,強化確認客戶身分

地政士及不動產經紀業於確認客戶身分時,應採取合理措施辨識現任或曾任國內外政府或國際組織重要政治性職務之客戶或受益人與其家庭成員及有密切關係之人(以下簡稱重要政治性職務人士),並依前條規定,採取強化確認客戶身分措施。

第八條第五項第一款及第二款所列對象,其實質受益人為重要政治性職務人士時,不適用前項規定。

第 13 條:

地政士、不動產經紀業,應留存下列交易紀錄

地政士及不動產經紀業從事與不動產買賣交易有關之行為時,應留存下列交易紀錄。但交易案件確無該交易紀錄者,不在此限:

一、地政士

(一)不動產買賣契約書。

(二)定金及價款收支證明文件。

(三)交易帳戶號碼。

(四)簽證文件。

(五)受託事項往來文件。

二、不動產經紀業

(一)不動產委託銷售契約書。

(二)不動產買賣契約書。

(三)要約書。

(四)斡旋金、定金及價款收支證明文件

(五)交易帳戶號碼。

(六)受託事項往來文件。

前項交易紀錄得以專卷檔案或電子檔案方式留存,其保存期間自交易完成時起,至少五年。但其他法律有規定較長保存期間者,從其規定。

第 14 條:

司法機關依法要求時,應迅速提供

依第八條及前條規定留存之身分資料及交易紀錄,於法務部調查局(以下簡稱調查局)或司法機關依法要求時,應迅速提供,以重建個別交易。

第 14-1 條:

申報資料及相關紀錄憑證之保存

地政士及不動產經紀業對於客戶之不動產買賣交易涉及一定金額以上之通貨交易,應依調查局所定之申報格式及方式,於交易完成後十個工作日內向調查局申報。但一定金額以上通貨交易為代收款項且收受時已申報者,地政士及不動產經紀業再將同款項存入信託專戶或賣方金融帳戶時,免向調查局申報。

前項申報資料及相關紀錄憑證之保存,應依第十三條第二項規定辦理。

第 15 條:

地政士及不動產經紀業,發現下列情事者,應向調查局申報

地政士及不動產經紀業從事與不動產買賣交易有關之行為時,發現下列各款情事之一者,應向調查局申報:

一、客戶有第九條各款所定情形之一。

二、交易金額源自高風險國家或地區,或支付予該國家或地區之帳戶或人員,且無合理說明。

三、客戶或資金來源或去向疑似與恐怖活動、恐怖組織、資恐或資助武器擴散有關聯。

四、交易金額與客戶年齡、身分或收入顯不相當,且無合理說明資金來源。

五、客戶要求以一定金額以上現金或其他無記名工具作為定金或各期價款,且無合理說明。

六、客戶無正當理由,自行或要求多次或連續以略低於一定金額之現金或其他無記名工具支付定金或各期價款。

七、客戶要求將不動產權利登記予第三人,未能提出任何關聯或拒絕說明。

八、不動產交易資金來自第三人,或價金給付給第三人,且無合理說明。

九、不動產成交價格明顯異於市場行情且要求在相關契約文件以不實價格記錄。

十、其他疑似洗錢交易或資恐情事。

第 16 條:

以郵寄、傳真、電子郵件或其他方式,向調查局申報

地政士及不動產經紀業應於發現前條各款情事之一之日起十個工作日內,填具調查局所訂申報書表,並由地政士簽章或不動產經紀業蓋用戳章,併同相關證明文件以郵寄、傳真、電子郵件或其他方式,向調查局申報。不動產買賣交易未完成者,亦同。

屬重大或緊急之疑似洗錢或資恐交易案件,地政士及不動產經紀業應立即依前項方式填具申報書表,以傳真或其他方式申報。

前二項申報紀錄,地政士及不動產經紀業應自申報日起,至少保存五年。

第 17 條:

通報方式及通報紀錄之保存年限

客戶為依資恐防制法第四條第一項或第五條第一項公告制裁名單指定(以下簡稱指定制裁)之個人、法人或團體者,地政士及不動產經紀業,不得為其從事不動產買賣交易有關行為;已從事者,應即停止。

第三人受指定制裁之個人、法人或團體委任、委託、信託或因其他原因而為其持有或管理財物或財產上利益,適用前項規定。

地政士及不動產經紀業因執行業務知悉持有或管理經指定制裁之個人、法人或團體之財物、財產上利益或其所在地者,應向調查局通報。

前項通報方式及通報紀錄之保存年限,準用前條規定。

第 18 條:

相關資訊,應保守秘密,不得任意洩露

地政士事務所及不動產經紀業所屬人員,對所發現疑似洗錢或資恐交易情形及向調查局申報之相關資訊,應保守秘密,不得任意洩露。

第 19 條:

舉辦防制洗錢及打擊資恐之教育訓練

中華民國地政士公會、中華民國不動產仲介經紀商業同業公會及中華民國不動產代銷經紀商業同業公會之全國聯合會,每年應舉辦防制洗錢及打擊資恐之教育訓練、研習會或宣導說明會,並將辦理情形報內政部備查。

第 20 條:

本辦法自發布日施行

本辦法自發布日施行。

本辦法修正條文施行日期,由內政部定之。

110_年地政士及不動產經紀業

防制洗錢及打擊資恐辦法修正QA

Article 1

These Regulations are enacted in accordance with Paragraph 3 of Article 6, Paragraph 4 of Article 7, Paragraph 3 of Article 8, Paragraph 3 of Article 9, and Paragraph 3 of Article 10 of the Money Laundering Control Act, as well as Paragraph 5 of Article 7 of the Counter-Terrorism Financing Act.

Article 2

The terms used in these Regulations are defined as follows:

1. Land administration agents: individuals who have obtained a land administration agent certificate or a professional land registration agent certificate in accordance with the Land Administration Agent Act and have obtained a land administration agent practicing license to practice as land administration agents.

2. Real estate brokerages: companies or firms that engage in real estate brokering or real estate sales transactions on behalf of others in accordance with the Real Estate Broking Management Act.

3. Customers: both parties that are involved in a real estate transaction.

4. Beneficial owners: natural persons who ultimately own or control the customers or the natural persons on whose behalf a transaction is being conducted, including those persons who exercise ultimate effective control over a legal person or arrangement.

5. High-risk countries or areas: countries or areas specified in Paragraph 2 of Article 11 of the Money Laundering Control Act.

6. Business relationship: having conducted three or more real estate transactions for the same customers within five years.

7. A certain amount: NT$500,000 or the foreign currency equivalent thereof.

8. Cash transaction: cash receipt or payment in a single transaction.

Article 3

Land administration agents and real estate brokerages shall carry out anti-money laundering and counter-terrorism financing tasks in accordance with these Regulations while engaging in acts related to a real estate transaction.

Article 4

Land administration agents and real estate brokerages shall establish internal control measures and auditing systems according to money laundering and terrorism financing risks and the business size while complying with the following provisions:

1. High-level executives or other personnel authorized by them shall launch operation and control procedures against money laundering, and shall reform such procedures on a regular basis.

2. Dedicated personnel shall be appointed to take charge of the coordination and supervision of implementation of the measures set forth in the preceding subparagraph.

3. Land administration agents and real estate brokerages shall regularly organize or participate in on-the-job training programs on anti-money laundering and counter-terrorism financing.

4. Land administration agents and real estate brokerages shall compile and regularly update their money laundering and terrorism financing risk assessment reports.

5. Land administration agents and real estate brokerages shall watch if their employees fall under the disqualification conditions set forth in Paragraph 1 of Article 6 of the Land Administration Agent Act or Paragraph 3 of Article 14 of the Real Estate Broking Management Act.

6. Auditing procedures shall be established.

When compiling the risk assessment reports specified in Subparagraph 4 of the preceding paragraph, land administration agents and real estate brokerages shall take into account such risk factors as customers, the nature of products or services, the fact whether high-risk countries or areas are involved, and payment methods.

Article 5

The Ministry of the Interior shall each year inspect how land administration agents and real estate brokerages implement the internal control measures and auditing systems in regard to anti-money laundering and counter-terrorism financing, and may appoint subordinate agencies, or authorize or commission other agencies (institutions), legal persons, or associations, to perform such inspections.

The inspections set forth in the preceding paragraph may be performed on site or not. Land administration agents and real estate brokerages must not avoid, reject, or obstruct said inspections.

Article 6

Land administration agents and real estate brokerages shall, prior to the launch of new products or services, assess money laundering and terrorism financing risks and establish management measures that will reduce risks.

The new products or services, as set forth in the preceding paragraph, include the application of new payment methods or new technologies to relevant products or services.

Article 7

Land administration agents and real estate brokerages shall verify the identity of customers under the following circumstances:

1. Conducting a real estate transaction;

2. Establishing a business relationship;

3. Discovering suspicious acts of money laundering or terrorism financing;

4. Having doubts about the veracity of the previously obtained customer identification information.

Land administration agents and real estate brokerages shall not allow customers to conduct a transaction anonymously or using fake names.

Land administration agents and real estate brokerages shall, in the course of establishing a business relationship with customers, understand the purpose and nature of such a business relationship.

Article 7-1

Land administration agents and real estate brokerages shall verify the identity of the customers by themselves, and don’t entrust a third party to execute.

Article 8

Land administration agents and real estate brokerages shall comply with the following provisions when verifying the identity of customers and retaining or recording the identification information thereof:

1. If the customer is a natural person, land administration agents and real estate brokerages shall examine the customer’s national identification card, national health insurance card, passport, resident certificate, or other documentation sufficient to prove their identity, retain or record the customer identity information, such as the customer’s name, date of birth, address, and national identification number, and enquire about the customer’s occupation and telephone number which shall be duly recorded.

2. If the customer is a legal person or association, land administration agents and real estate brokerages shall retain or record the following information in order to understand the nature of the customer’s main business:

1. Its name, taxpayer identification number, telephone number, and the name of its responsible person;

2. Incorporation or registration documents;

3. Constitution; however, this provision does not apply if no constitution is required according to the regulations or the customer is among those specified in Paragraph 5;

4. A roster of directors and supervisors; however, this provision does not apply if no directors and supervisors shall be appointed according to the regulations;

5. The registered address and address of the principal place of business.

In the event that the representative of the customer engages in acts related to a real estate transaction, in addition to verifying the identity of the representative and retaining or recording its identification information in accordance with the preceding paragraph on a mutatis mutandis basis, the validity of the authorization to engage in such transaction shall be confirmed.

If the customer is a legal person or association, land administration agents and real estate brokerages shall, in accordance with the following provisions, understand the ownership and control structure of the customer, verify the identification information of beneficial owners, and retain or record such information:

1. A request shall be made to the customer for the identification information about the natural person that has ultimate control, to wit, a roster of the shareholders that directly or indirectly possess more than 25% of the shares or capital of the legal person or relevant documents.

2. In the event that no natural person that has control is found in accordance with the preceding subparagraph or there are doubts, the natural person that exercises control over the customer in other ways shall be identified. If no such natural person is found, the identity of the directors, supervisors, or natural persons of equivalent positions shall be verified.

In the event that a trustee engages in acts related to a real estate transaction or registers real estate rights under the name of a third party, the identity of the customer and the trustee, supervisor, beneficiary, or third party shall be identified using the identification information specified in the first and preceding paragraphs on a mutatis mutandis basis, and such information shall be retained or recorded.

When the customer or its representative or trustee has any of the following statuses except for high-risk countries or regions, the provisions of the preceding two paragraphs governing the verification of beneficial owners shall not apply:

1. Government agencies, state-owned enterprises, or public or private schools in R.O.C.;

2. Foreign government agencies;

3. TWSE-listed and TPEx-listed companies or their subsidiaries;

4. Publicly traded and over-the-counter listed companies or their subsidiaries which are listed abroad and, according to the regulations of the jurisdiction(s) where the companies are located, are required to disclose their major shareholders;

5. Domestic financial institutions or foreign financial institutions that have set up a branch office in R.O.C.;

6. Financial institutions established outside R.O.C. that are subject to and governed by the anti-money laundering and counter-terrorism financing requirements consistent with the standards set by the Financial Action Task Force (FATF) on Money Laundering.

Land administration agents and real estate brokerages shall retain the identification information set forth in Paragraphs 1 to 4 for a period of at least five years from the termination or completion of a transaction. However, where other laws provide for a longer retention period, such laws shall prevail.

Article 8-1

In addition to verifying the identity of the customers in accordance with the provisions of the preceding article, land administration agents and real estate brokerages shall comply with the following provisions:

1. Establishing policies and procedures for watch list filtering, based on a risk-based approach, to verify whether customers, beneficial owners or connected parties of the customers are individuals, legal persons or organizations sanctioned under the Terrorism Financing Prevention Act or terrorists or terrorist groups identified or investigated by a foreign government or an international organization;

2. Shall document and maintain the records for a time period in accordance with Paragraph 6 of the preceding article.

Article 9

If any of the following circumstances occurs when land administration agents and real estate brokerages are verifying the identity of a customer, they shall decline the transaction concerned:

1. The customer is suspected of conducting the transaction anonymously or using a fake name, a nominee, a shell firm, or a shell corporation or entity;

2. The customer refuses to provide the documents required for verifying its identity;

3. The customer uses forged or altered identification documents;

4. The customer is an individual, a legal person, or an association designated for sanctions under the Counter-Terrorism Financing Act, or a terrorist or a terrorist group identified or investigated by a foreign government or an international organization.

5. Any of the following circumstances occurs, and there is a reasonable suspicion that the customer may be involved in money laundering or terrorism financing:

(1) All the identification documents presented are photocopies;

(2) The documents provided by the customer are suspicious or unclear so that the documents cannot be authenticated, or the customer refuses to provide other supporting documents;

(3) The customer procrastinates on providing necessary or supplementary identification documents without any reason;

(4) Other unusual circumstances occur, and the customer fails to provide reasonable explanations.

Article 10

For customers with whom a business relationship has been established, land administration agents and real estate brokerages shall conduct ongoing customer due diligence based on the following principles:

1. They shall scrutinize the transactions conducted by customers and ensure that the transactions are consistent with the nature of customers’ business and their money laundering and terrorism financing risk profile. They shall also investigate the sources of their funds if necessary.

2. They shall review, on a regular basis, whether the identification information about customers and beneficial owners is sufficient.

3. They shall conduct due diligence on existing customers again on the basis of materiality, risk, and results of the previous due diligence task. This principle shall also apply when they learn about any material change in customers’ identity and background information.

4. If they have doubts about the veracity of customers’ information, suspect that customers are involved in money laundering or terrorism financing, or observe an unusual, material change in the way that customers conduct transactions, they shall verify the identity of customers again in accordance with Article 8.

Article 11

If customers or the countries or areas involved in their transactions have high money laundering or terrorism financing risks, land administration agents and real estate brokerages shall perform enhanced customer due diligence measures as follows:

1. Obtaining approval from senior management before a transaction is conducted;

2. Adopting reasonable measures to investigate the sources of customers’ funds;

3. Continuing to monitor ongoing transactions.

Article 12

For the purpose of verifying the identity of customers, land administration agents and real estate brokerages shall undertake reasonable measures to identify the customer or beneficiary who has or had prominent public functions in a domestic or foreign government or international organization as well as individuals with a close relationship with the family members of such customer or beneficiary (hereinafter referred to as politically exposed persons), and shall perform enhanced customer due diligence measures in accordance with the preceding article.

The preceding paragraph does not apply if the beneficial owners of those specified in Subparagraphs 1 and 2 of Paragraph 5 of Article 8 are politically exposed persons.

Article 13

Land administration agents and real estate brokerages shall retain the following transaction records in the course of engaging in acts related to a real estate transaction. But if there are no such transaction records for the transaction, this provision shall not apply:

1. Land administration agents:

(1) A real estate sale and purchase contract;

(2) Certificates of payment of the earnest and transaction amount;

(3) The transaction account number;

(4) Attesting documents;

(5) Correspondence regarding the matters entrusted.

2. Real estate brokerages:

(1) A commission contract for selling real estate;

(2) A real estate sale and purchase contract;

(3) An offer document;

(4) Certificates of payment of the negotiation earnest, earnest, and transaction amount;

(5) The transaction account number;

(6) Correspondence regarding the matters entrusted.

The transaction records specified in the preceding paragraph may be retained in paper form or electronic form, and such records shall be retained for a period of at least five years from the date of completion of the transaction. However, where other laws provide for a longer retention period, such laws shall prevail.

Article 14

The identification information and transaction records retained in accordance with Article 8 and the preceding article shall be provided promptly upon a request duly made by the Investigation Bureau of the Ministry of Justice (hereinafter referred to as the Investigation Bureau) or judicial authorities, so as to reconstruct individual transactions.

Article 14-1

Land administration agents and real estate brokerages shall report to the Investigation Bureau in the format and method thereof prescribed by the Investigation Bureau within 10 business days after the cash transaction with respect to cash transactions above a certain amount. However, if the cash transactions above a certain amount are collections of payments on behalf of the sellers and have been reported at the time of receipt, land administration agents and real estate brokerages will be exempted from reporting to the Bureau of Investigation when the same payments are deposited into the trust accounts or the sellers’ financial accounts.

The reporting records and related record vouchers for handling the provision of preceding paragraph shall be retained in accordance with Paragraph 2 of Article 13.

Article 15

Land administration agents and real estate brokerages shall report to the Investigation Bureau any of the following conditions discovered in the course of engaging in acts related to a real estate transaction:

1. Any of the circumstances set forth in all the subparagraphs of Article 9 occurs to the customer.

2. The money for the transaction comes from a high-risk country or area, or is paid to an account or individual in such a country or area without a reasonable explanation.

3. The customers or the source or destination of funds are suspected to be related to terrorist activities, terrorist organizations, capital terrorism, or financing the proliferation of weapons.

4. The amount of the transaction is apparently inappropriate for the age, status, or income of the customer without providing a reasonable explanation for the source of the funds.

5. The customers require cash or other unregistered instruments above a certain amount as the deposit or the price of each period without a reasonable explanation.

6. The customers, without a reasonable explanation, require to pay the deposit or the price of each period with cash or other unregistered instruments that is slightly less than a certain amount several times or continuously.

7. The customer requests the registration of the real estate rights to be made under a third party, and is unable to provide an explanation for their relationship or refuses to provide an explanation.

8. The real estate transaction funds come from a third party or deliver to a third party without a reasonable explanation.

9. The actual real estate transaction price is obviously different from the prevailing market price, and a request is made to record false price in relevant contract documents.

10. Other suspicious acts of money laundering or terrorism financing are committed.

Article 16

Land administration agents and real estate brokerages shall, within ten working days from the day when any of the conditions set forth in the preceding article is discovered, submit by mail, fax, e-mail, or other means a completed reporting form designated by the Investigation Bureau and affixed with the signature or seal of the land administration agents or the seal of the real estate brokerages, together with relevant supporting documents, to the Investigation Bureau. The same provisions shall also apply when real estate transactions are not completed.

For significant suspicious money laundering or terrorism financing activities or suspicious money laundering or terrorism financing activities of urgent nature, land administration agents and real estate brokerages shall immediately submit a reporting form, as required in the preceding paragraph, by fax or other means.

Land administration agents and real estate brokerages shall retain the reporting records set forth in the preceding two paragraphs for a period of at least five years from the date of reporting.

Article 17

In the event that the customer is an individual, legal person, or association designated on the sanction list published in accordance with Paragraph 1 of Article 4 or Paragraph 1 of Article 5 of the Counter-Terrorism Financing Act (hereinafter referred to as designated individual, legal person, or association), land administration agents and real estate brokerages shall not engage in acts related to a real estate transaction for the said customer, and shall immediately stop any ongoing acts.

The preceding paragraph shall apply when a third party is appointed, commissioned, entrusted, or authorized for other reasons by any designated individual, legal person, or association to possess or manage property or property interests for such an individual, legal person, or association.

Land administration agents and real estate brokerages shall file a report with the Investigation Bureau upon becoming aware of those who possess or manage the property or property interests of a designated individual, legal person, or association or the place where such property or property interests are located in the course of their duties.

The preceding article shall apply mutatis mutandis to the aforesaid reporting methods and the retention period of reporting records.

Article 18

Employees of a land administration agent office or real estate brokerage shall keep confidential any suspicious money laundering or terrorism financing activities discovered and any related information reported to the Investigation Bureau, and shall not disclose such information without permission.

Article 19

The Land Administration Agent Association of R.O.C., Chinese Association of Real Estate Brokers, and Real Estate Marketing Agency Association of the R.O.C. shall organize training sessions, seminars, or presentations regarding anti-money laundering and counter-terrorism financing each year, and shall report the implementation status to the Ministry of the Interior for recording.

Article 20

These Regulations shall come into effect on the date of promulgation.

The implementation date of the amendments to the provisions of this regulations shall be determined by the Ministry of Interior.