如何選擇最適合自己的房貸方案

選擇最適合自己的房貸方案可以幫助您節省利息支出和還款壓力。以下是一些幫助您選擇最適合自己的房貸方案的建議:

- 了解自己的財務狀況:在申請房貸之前,您需要了解自己的財務狀況,包括收入、支出和債務狀況等。通過了解自己的財務狀況,您可以更好地理解自己的還款能力和貸款需求。

- 比較不同銀行的貸款方案:不同銀行的貸款方案可能有所不同,包括貸款利率、還款方式、貸款期限等。因此,您需要比較不同銀行的貸款方案,找到最適合自己的方案。

- 評估不同貸款類型的風險和優缺點:房貸的不同類型包括固定利率貸款、浮動利率貸款和混合利率貸款等。每種貸款類型都有其風險和優缺點,您需要評估每種貸款類型的風險和優缺點,找到最適合自己的貸款類型。

- 考慮未來的還款能力:在選擇房貸方案時,您需要考慮未來的還款能力。如果您預計收入會增加,您可以考慮較短的貸款期限;如果您預計還有其他大額支出,您可以考慮較長的貸款期限。

- 確認貸款條款:在申請房貸之前,請仔細閱讀貸款條款,確認貸款利率、還款方式、貸款期限等細節。如果您對條款有任何疑問,請與銀行聯繫,請他們進一步解釋。

最後,建議您在選擇房貸方案時,請仔細考慮自己的財務狀況和還款能力,並仔細閱讀貸款條款,確保您能夠按時還款並避免違約。

辦理銀行房貸時,你最在乎的是,哪家銀行的貸款利率最低嗎?其實,銀行利率高低並不是唯一的考量!貸款期間長短、每月繳款負擔、要不要寬限期、自己的投資理財能力,都是需要考量的。而如果選對了房貸方案,不僅可以輕鬆繳款,還可能讓你多賺錢唷。

銀行房貸條件包含了貸款成數(貸款金額)、利息、寬限期、貸款年限,如何選擇最適合自己的銀行房貸方案,甚至結合儲蓄、保險等其他理財工具,為自己省下利息並增加保障,真的是一門大學問。以下步驟將協助你挑選最適合自己的房貸方案:

-

Step1 設定自己適合的利率:

由於利息條件直接影響購屋成本,因此,申請前多比較各銀行的房貸利率是絕對必要的,因為差一碼(0.25%) 的利息,長期下來也是相當可觀喔!依照「利率是否浮動」的標準,大致上可分為以下三種銀行房貸方案:

|

房貸類型 |

說明 |

|

指數型房貸 |

指數型房貸利率=定儲利率+加碼利率。利率隨著市場利率變動而機動調整,雖然當利率調升時,此一指標利率也會隨之上揚,但由於加碼利率明確,使得利率定價公平而透明。如果採用指數型房貸,可以選擇季調,由於升息時間會比月調慢,可以達到省息的效果。 適合:有規律薪水的上班族 |

|

固定型房貸 |

利率固定,不受利率上漲、下跌的影響。一般而言,固定型房貸一開始的利息通常較指數型房貸高,但因利率固定不變,在目前央行升息不斷的情形下,可避免升息風險。由於每月繳款金額固定,每月支出不會因為利率波動而臨時更動,可以妥善安排家庭財務分配,確保家庭生活品質。 適合:預算有限且準備長期還款的首購族、雙薪家庭和預期未來利率可能走升的人 |

|

組合型房貸 |

結合固定與機動利率,可自由搭配金額比重。其中固定利率的部分完全不受市場利率波動影響,在利率上揚時,固定利率的部分可以鎖住利息負擔,若利率反向走跌,機動式利率的部分則可反映市場利率走勢,讓客戶有效掌握雙重優勢。 適合:想省息又想規避升息風險的人 |

除了「利率是否浮動」外,依照「利率結構」,

還可分為以下幾種房貸方案:

|

房貸類型 |

說明 |

|

一段式房貸 |

貸款期間的利率均用相同計算方式計息,通常搭配「指數型房貸」使用,在20-30年的貸款期限內,均以定儲利率加上固定百分比的利率。一段式利率通常在每個月支付的貸款金額差異不大,僅隨市場利率微幅波動,前兩年的利率雖較高,但長期來看利息較優惠。 適合:貸款初期付款輕鬆及還款能力佳的人 |

|

二、三段式利率 |

將還款期間分做二或三段,採取不同的利率計息。如果是二段式,第一段通常為前2年,第二段為為第3年起。如果是三段式,第一段通常為前6個月,第二段為第7∼24個月,第三段則為第3年起。通常二、三段式的利率結構,前2年利率通常低於一段式利率,但第3年起利通常會支付較高的本息負擔。 適合:希望前兩年利息負擔較輕的人 |

|

利率遞減型房貸 |

一種依據顧客繳息情形提供利率回饋的房貸產品。房貸利率依指數型房貸計息,若顧客每月按時繳息,利率即享有減碼優惠。 適合:雙薪家庭者、有固定還款來源者,或是對利率敏感度較高的上班族或避險族等 |

-

Step2 選擇自己適合的方案:

房貸產品越來越多元化,除了傳統的房屋買賣價金貸款外,有些銀行推出的房貸方案結合了理財、儲蓄、保險等工具,增加貸款靈活的運用,加速房貸清償時間、減少利息支出。以下為各種常見貸款方案,可視自己的需求進一步詢問銀行喔!

|

房貸類型 |

說明 |

|

理財型房貸 |

一般房貸還款後的本金部分不能再動用,而理財型房貸的還款本金(包括每月攤還之本金及提前部分還款之本金)會轉換為循環額度,雖利率較一般房貸略高,但可隨時動用、隨借隨還按日計息,不動用不計息,活化不動產,擁有更多資金運用的彈性。 適合:有理財規劃、短期投資、房屋修繕及備用金需求者,或者中小型企業人士 |

|

抵利型房貸 |

以存款來折抵房貸本金,以減少利息支出,達到降低每月攤還金額或縮短還款年限的效果。如果臨時面臨資金需求,還是可以動用該筆存款。 適合:有存款,但希望保留資金運用彈性,不想提前還款,但希望降低房貸負擔者 |

|

保險型房貸 |

與保險結合的房貸產品,保費通常較一般定期壽險為低,一般分為「遞減型」與「平準型」兩種,遞減型是依據房貸的還款金額,讓保額逐步遞減,平準型則是在保障期間內都維持相同保額。其優點在於,若承貸戶意外身故,則等同於房貸金額的保險理賠金,可優先償還房貸,避免不動產因無法按時繳交本息,房子遭法拍的風險。一旦理賠金償還房貸款後的餘額,還可給付給受益人,讓生活更有保障。若消費者提前償還房貸,也可選擇繼續享有保障或依相關條款退保領取解約金。 適合:身為家中經濟主要來源者 |

|

保證保險型房貸 |

當房貸核貸金額不敷需求時,利用「額外投保」的方式,增加貸款金額。房貸戶可透過保險取得不足的金額,而銀行業者也可透過保證保險,將風險轉嫁給保險公司。 適合:自備款不足或信用條件不足者 |

-

Step3 規畫房貸年限 & 決定房貸還款方式:

一般房屋貸款年限分為20年(較常見)或30年,至於一般房貸還款方式,則可分為以下兩種:

本息平均攤還:

在利率不變的條件下,每月攤還本金與利息的總合固定,對於還款預算較易掌握。適合固定薪水、每月預算固定的上班族,是目前市面上較常見的還款方式。

本金平均攤還:

每月攤還之本金固定,但每月償付之利息則逐月遞減,由於期初還款金額較多,因此可節省較多的利息支出。適合手邊有現金較多的民眾或每月收入遠大於支出者。

首次購屋者為避免剛買屋造成負擔過大,可以向銀行申請寬限期1-2年,也就是說這1-2年間只要交利息,不需攤還本金。雖然可降低購屋初期的壓力,但也必須衡量自己寬限期後每月本利攤還的負擔是否過大喔!每月繳交金額可以透過【簡易貸款試算】試算。

- Step4 選擇銀行:

瞭解了上述關於利息與各類房貸工具後,接下來就要挑選銀行了!為了方便買方針對各銀行的房貸方案進行比較,鉅軒代書小編將【銀行優惠房貸】、【壽險優惠房貸】整理於房貸試算工具中。挑選房貸銀行以服務熱忱、重視行員專業訓練、替客戶著想的優質銀行為先。此外,提醒你,各家銀行的房貸方案雖有差異,但實際核貸的內容還是依個人條件與房屋鑑價而定喔!建議可與2-3家銀行房貸業務詢問、討論,再依各業務提供的內容多方比較再做決定喔!

- Step5 善用政府優惠方案減輕利息壓力:

除了銀行的房貸外,為了協助國民購屋,政府不定期也會提供優惠房貸方案。如果你符合青年首購條件或中低收入、弱勢家庭,不妨多善用政府優惠方案,減輕利息壓力。申辦房貸前可參考【政府優惠房貸】內容。

房貸怎麼省錢-把握5大原則

不動產變動產

房奴擺脫窮到只剩房的窘日子

時下許多年輕人總是望屋興嘆,加上薪水不漲、房價不跌,買房應是遙遙無期。鉅軒房地產總經理提供兩大方向,「及早規劃」、「把握335原則」,建議青年族群先從交通動線上的區域入手,先求有再求好。

藉由以上五個步驟,就能逐項評估選擇最適合自己的房貸方案。此外,由於未來利率波動的可能性較大,提醒你,在申請貸款時,務必考量自身的還款能力,尤其是首購族,最好遵守「335原則」:準備3成自備款,每月房貸支出不超過家庭總收入的3分之1,房屋總價不超過家庭年收入的5倍。

不但輕鬆成家,也能讓資金運用更充裕。如果貸款後,資金週轉真的出現問題,也不要輕易違約,最好趕快去跟銀行協調,例如延長還款期限,以減輕每月繳款負擔,避免房貸繳不出來、房屋被銀行法拍的風險喔!

敢欠銀行錢不還?想躲15年追溯期?

追到你天荒地老!

很遺憾,欠銀行錢是一種合約上的債務,必須根據協議進行還款。具體來說,逾期還款可能會導致額外的費用和利息,對信用評分造成負面影響,甚至會導致債務追討和訴訟。

如果你無法按照協議還款,建議盡早與銀行聯繫並討論可能的還款計劃或延期付款的方案,以免造成更大的財務損失和信用風險。

此外,銀行每隔一段時間會公布呆帳大戶,引起各方媒體記者注目,上億元呆帳戶紛紛曝光。但其實百萬小呆帳戶,銀行也不會放過的。民法雖然規定債權十五年,但是銀行續追呆帳,都會一直展延,只要走法院,時效可以一直延續,欠款不還錢,銀行『恐怖追殺令』真的會追你到天荒地老。

台北二胎房貸利率

管道與申請條件總整理

台北是台灣蛋黃區,雖然買房困難,但相對的若擁有房產,除了居住以外還能更活化其價值。二胎房貸因申貸人條件不同,適合的貸款管道也有所不同,然而不同的二胎房貸管道差別很大,像是貸款成數、額度、利率、還款方式、手續費用,深深影響著申貸人的房屋二胎貸款權益,這篇將帶大家來清楚了解所有二胎房貸管道的細節,申辦二胎房貸前增加判斷能力,以免被不肖業者用各種收費名目坑錢!

房地產權不清楚

產權不完整「持分房屋土地」可以貸款嗎?

當房地產物件「產權不完整」無法貸款時,我可以嘗試持分貸款嗎?

土地持分貸款是什麼?當土地產權不完整也能借到錢嗎,而又該怎麼借呢?

在台灣這塊地狹人稠的土地上,寸土寸金的景象常看到,而你有聽說過持分房屋&土地嗎?很多老一輩的人常常因為曾經家裡有一塊土地,家族又有好幾個人時,一塊土地透過繼承、贈與、過戶等因素,將土地產權被多人分別共同持有,這時候這塊地,也就是所謂的「持分物件」。如果當你有一塊持分房屋土地,又剛好急需一筆錢週轉時,可以利用這塊持分房屋土地借到一筆資金嗎?條件又有哪些呢?需要共同的土地持有人同意嗎?

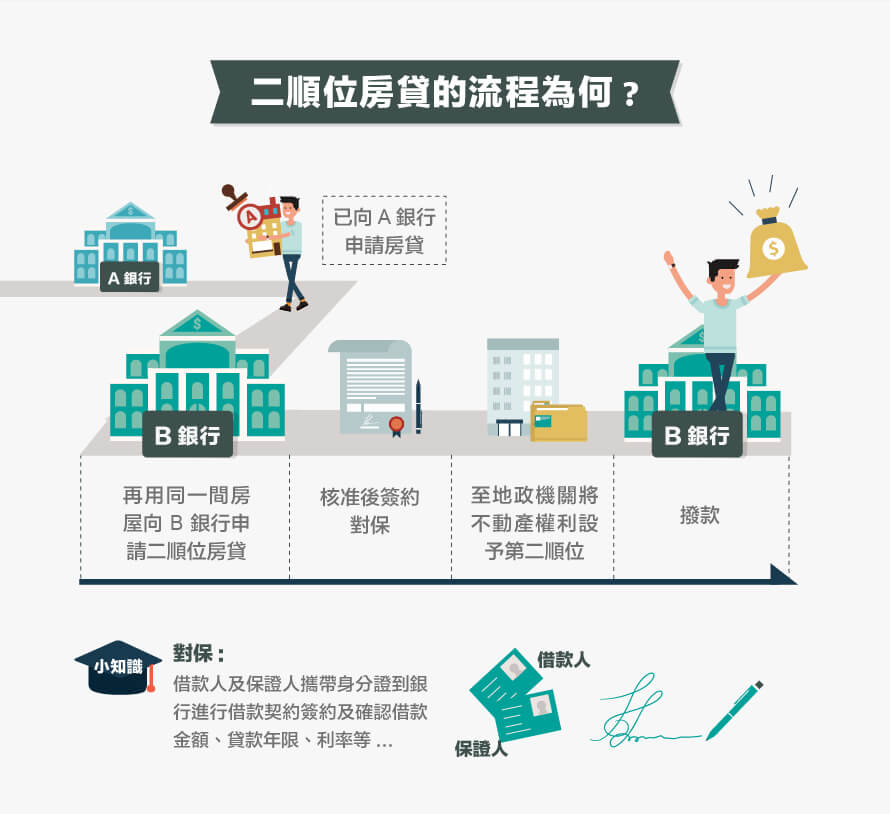

二胎房貸是什麼?

完整解析申請條件、流程及常見問題

房屋貸款的利率低、還款期數長,是很多人解決資金問題的主要方法,但很多人可能不知道,房產在申請過一次貸款之後,還能再申請二胎房貸(又稱二順位房貸),將房地產的價值再次利用,提供更多靈活運用資金的空間,究竟二胎房貸是什麼?申請時有哪些條件限制?本文為您整理了二胎房貸申請流程及常見問題,幫助您深入了解二胎房貸。

為什麼申請土地貸款過件率低?

土地分類、貸款申請流程、如何提升過件率

所謂的土地貸款,也被稱為「土地抵押貸款(land mortgage loan)」,土地貸款是指借款人將土地的使用權,抵押設定給銀行後所取得的資金。

因此土地貸款可藉由土地做為貸款的擔保品向銀行申請貸款,並透過土地所在地的地政機關,完成土地抵押權設定,成功申貸將資金投入開發,獲利並償還貸款。

但申請土地貸款前,是否清楚:

一、甲種建築用地:供山坡地範圍外之農業區內建築使用者。

二、乙種建築用地:供鄉村區內建築使用者。

三、丙種建築用地:供森林區、山坡地保育區、風景區及山坡地範圍之農業區內建築使用者。

四、丁種建築用地:供工廠及有關工業設施建築使用者。

農地貸款95%的銀行都不受理怎麼辦?

持分農地貸款好申請嗎?五分鐘帶你了解!

原則上大部分銀行是不願意受理農地貸款業務的,僅剩極少數銀行有意願承攬!但就是因為很少有銀行承作,所以這些銀行在審核上就非常嚴格、放款額度也不高,在申貸上主要有3大條件限制導致一般人不容易通過:

▶身份限制:需為農民身份或農業相關從業人員,且信用良好無信用瑕疵,有穩定收入者

▶用地限制:農地的土地謄本上使用分區必須為農業使用,若農地上有建築物需有合法的保存登記

▶資金用途限制:資金需運用在興建農舍,購買農地、農舍或添購農業用相關生財工具

光這3點就讓大多數人打退堂鼓,有些銀行甚至要求申貸者需加入農會,或申貸時提出營運計畫、資金用途說明報告書及還款能力與收入來源說明,光是寫到這邊大概很多人都直接放棄了吧!但別絕望的太早,其實可以透過民間以及少數的金融機構來申請農地貸款即可解決上述這些問題唷!

信貸是什麼?信貸額度有多少?

信貸條件?揭露銀行不會說的關鍵數字

什麼是信用貸款?

信貸也就是信用貸款,是指銀行根據借款人的信譽所發放的貸款,申請時不需要提供任何擔保,因此又稱為無擔保貸款。現在很多貸款產品都需要抵押或者擔保,而信用貸款不用。它的最大特點就是申貸人既不用提供任何抵押品,也不用去找第三方來擔保,僅憑申請人的信譽就可以取得銀行貸款,並以借款人的信用作為還款的保證。銀行一般都會重點申請者的收入是否穩定及個人信用記錄情況來進行審核,以免產生呆帳。

信用貸款最高可以貸多少錢?

信貸額度主要看「負債收支比」,同時還有負債比的限制,貸款額度不得超過借款人月薪的 22 倍。如果你月薪 5 萬,額度最高不超過 110 萬。

房貸詐騙!是貸款還是詐騙?

急需用錢更該小心!防止貸款詐騙3個方式說明!

國內消費者金融需求高漲,不過,投資詐騙案件卻也跟著暴增。對此,警政署165反詐騙以最近3個月比較,由消費者提報的「假貸款真詐騙」的案件數,11月比9月激增了整整4倍;警政署165呼籲民眾辨識三種新型態金融偽裝詐騙術,提升自我防詐抵抗力。

國內有3大新型態金融偽裝詐騙術

偽冒銀行或金融機構發送釣魚簡訊

誘騙民眾立即點開短連結,一旦上當點開網址,恐遭植入木馬程式,或歹徒以仿真網路銀行頁面側錄受害者銀行帳號、密碼,將受害者存款轉出至人頭帳戶。

詐騙集團有竄改來電顯示號碼的技術

恐以銀行代表號或是權威機構電話號碼向民眾要求帳戶操作或是搜集敏感資訊,一步步誘騙被害者上當。市話開頭002、009,或電話開頭+的來電,務必警覺。

偽裝成銀行行員來電提供優惠貸款方案

留下假的銀行聯絡電話作為餌,等待民眾回撥電話上鉤後,告知優惠名額已滿,須先支付手續費後才能核貸,騙取民眾錢財。

另外:不少第一手屋主持有逾20、30年,因為房屋已經沒有設定抵押貸款,可快速過戶、取得貸款甚至轉賣,反而成為詐騙集團鎖定目標。所以已經繳清房貸的屋主,倒不如別去塗銷抵押設定,讓有心人士看到謄本資料時,避免成為鎖定目標。

一般買房子,銀行申貸條件中多要求以「最高限額抵押權」設定,所以謄本上會顯示「最高限額抵押權」與「擔保債權總金額」,設定的金額會高於實際房貸。資深的鉅軒代書表示,銀行房貸還清時,原貸款銀行會提供清償證明及抵押相關證明文件,此時可將文件送至地政機關塗銷銀行的抵押設定。

機車借款是什麼?有機車貸款推薦的嗎?

申辦前你需知道的8個注意事項!

若你正好有申請機車貸款計畫,可按照以下這4個步驟:

- 確認名下動產:確認名下有登記機車、摩托車、重型機車或Gogoro

- 確認貸款金額:因機車貸款能申貸的金額皆屬於小額貸款,無法申請到較高的額度,申請前先確認想貸款的額度

- 尋找申貸機構:因多數大型銀行較不受理機車貸款,可透過貸款顧問公司找到市面上較好的放款金融機構

- 備妥資料送審:準備好相關證件及文件,提出申請等待核貸結果

機車貸款陷阱有哪些?

關於機車貸款陷阱有哪些?PTT板上許多貸款人朋友都與我們分享過去遇到的例子,其中大部分案例都會是利息太高、被扣押證件、遇到高利貸等。以下我們也將做些重點整理,並用與您分享!

如何避開機車貸款詐騙陷阱?

PTT網友熱推3個高招請速記!

了解完常見的機車貸款陷阱後,接下來我們繼續跟你分享3招網友推薦的避雷妙招,幫助你輕鬆識破機車貸款詐騙套路,申辦更安心!

- 申辦貸款時,別聽信低利誘惑,向非法單位辦理,請尋求專業合法單位辦理,以免掉進黑心業者圈套

- 提醒您在簽訂契約時應詳細了解內容再簽立,勿隨意簽下空白契約和本票,以免造成終身遺憾

- 本所為政府立案代書,擁有頂尖代書團隊及專業的律師顧問,提供您安全的借貸平台,給您合法利率

- 本所以誠信保密為服務宗旨,針對客戶的相關資料及文件會妥善管理,辦理全程絕對保密